When you buy a new car, it will lose about 10% of its value the moment you drive it off the lot. There are a couple things working against new car owners in respect to the INSTANT depreciation of their vehicle.

Incentives

When a new car is purchased, other buyers likely assume there is some form of incentive received. Whether it’s “Employee Pricing” or “$4000 off for Costco Members,” buyers expect a similar discount, even if you didn’t. This is why negotiating the car’s price is crucial when making a purchase.

Here are a few incentives that dealerships offer:

Source: Bestcar.wiki

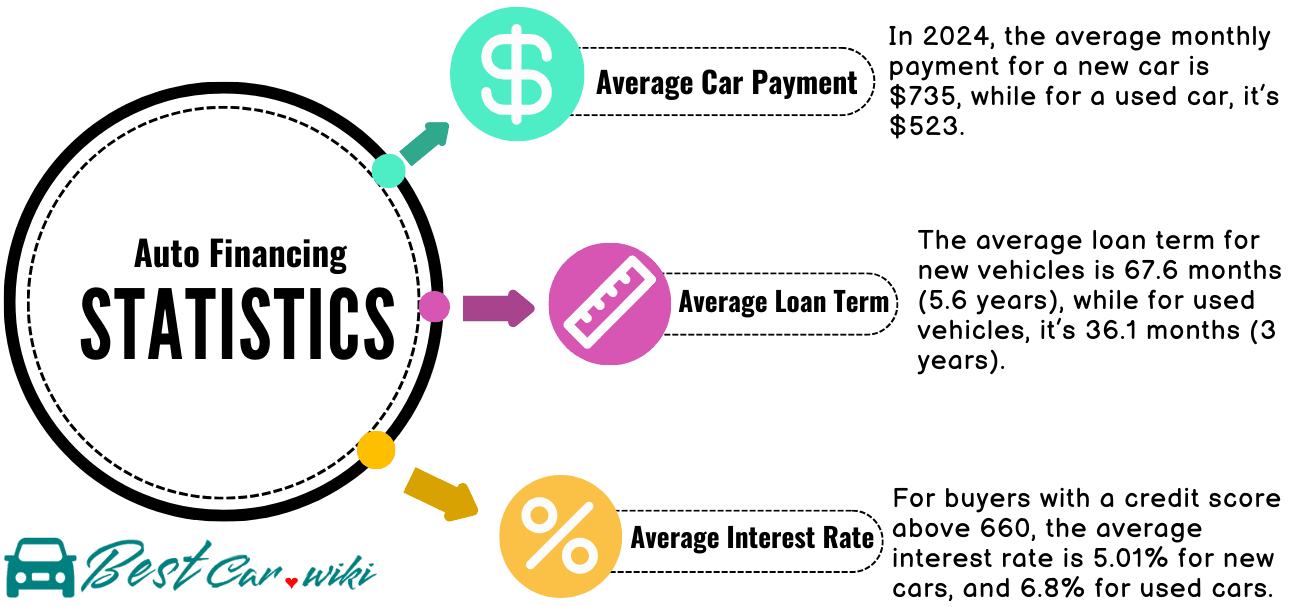

Financing Rates It’s quite common to see financing rates as low as 0% or 1% for new cars. Even rates of 3% or 4% are still highly attractive to buyers. Manufacturers often lose money on the financing portion of these deals, but they offer them because it significantly boosts vehicle sales.

Cashback offer: A cashback offer is a promotional incentive provided by car dealerships where a certain amount of money is returned to the buyer after the purchase of a vehicle. This amount can vary depending on the make and model of the car, the dealership’s policies, and current market conditions. The cashback can be applied directly to the purchase price, reducing the overall cost, or it can be given as a rebate after the sale is completed.

Trade-in offer: Whether you’re purchasing a new or used car, trade-in offers are available, but they can be particularly enticing for new car buyers. Dealerships frequently provide attractive trade-in values for used cars to motivate buyers to upgrade to a new vehicle. Additionally, a high trade-in value can significantly impact the sales tax on your new car. For instance, if you’re buying a $40,000 vehicle and have a $25,000 trade-in, you would only pay sales tax on the remaining $15,000. This can result in substantial tax savings, potentially reducing the amount owed by thousands in some states or provinces.

Unbeatable Finance Rates

When someone buys a car, they're likely to finance it. In fact, in 2023 over 79% of new vehicles were financed. Dealerships and manufacturers do not make much money on finance. They do it because they can sell new vehicles at lightning speed, driving their main business of selling cars.

Now, if someone wants to buy a used car, they're likely to finance it as well. The problem is it is impossible for them to get the rate of 0% or 1% that they would if they went to the dealership and bought a car. This results in $1000s of dollars in interest paid. As an example, a $40,000 finance loan of 1% interest is about $1,000 of interest paid over 5 years. If the rate was 6%, this would be $6,400 of interest paid over the same period. Some manufacturers will allow a loan to transfer at the same rate that the vehicle was purchased, but this is not common as they may add a few percentage points to the loan.

Source: Bestcar.wiki— USA, 2024

“Market for Lemons”

“A Market for Lemons” is a seminal paper written by George Akerlof in 1970. It explores the concept of asymmetric information in markets, using the used car market as an example. In this context, “lemons” refer to low-quality cars, while “peaches” refer to high-quality cars.

Key Points of “A Market for Lemons”:

- Asymmetric Information: Sellers know more about the condition of the car than buyers. This creates a risk for buyers, as they cannot be sure whether they are purchasing a high-quality car or a "lemon" (a defective or low-quality car)

- Adverse Selection: Because buyers are aware of the risk of purchasing a lemon, they are only willing to pay a price that reflects the average quality of cars in the market. This lower price discourages sellers of high-quality cars from participating in the market, leaving a higher proportion of lemons

- Market Collapse: Over time, the presence of more lemons in the market can lead to a market breakdown, where the quality of available cars continues to decline, and buyers become increasingly reluctant to purchase used cars

Source: Bestcar.wiki

How this affects newly purchased cars

- Risk Discount:When a car is brand new, buyers can be confident it has not been subjected to wear and tear or abuse, and it typically comes with a warranty. However, once the car is sold and becomes a "used" car, potential buyers must factor in the risk that the car might be a lemon. To compensate for this risk, buyers will only purchase the car at a significantly reduced price

- Perceived Quality: Buyers often prefer to purchase new cars to avoid the uncertainty associated with used cars. For instance, a buyer might choose a new car for $30,000 over an identical one-month-old car for $29,000 because they do not want to risk potential hidden issues with the used car. This preference drives down the value of the used car

- Depreciation Curve:The depreciation of a car is not linear. The value drops sharply in the first few months of ownership due to the transition from new to used status and the associated risk of unknown defects. After this initial steep decline, the depreciation rate slows down, reflecting the gradual wear and tear over time

Overall, the "market for lemons" theory highlights how information asymmetry and the resulting risk aversion among buyers contribute to the rapid depreciation of new cars once they are classified as used.